We will all die one day, as we know, but death remains a taboo subject in our societies that we avoid as much as possible to address. But reality quickly catches up with us when we lose a loved one.

Tips and tricks to make everyday life easier. (The article can be found below the video.)

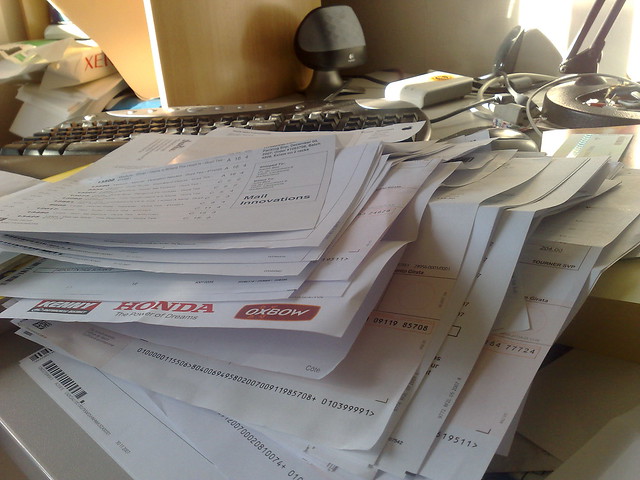

Often death strikes without warning. We find ourselves in a state of shock, without being able to think clearly. In these circumstances, having to deal with paperwork and other difficult matters within a few days of the death of a loved one seems like an overwhelming task for loved ones.

To make life easier for them after a death, it can be helpful to create an emergency list that shows the documents and data they will need in the event of death. Here are 9 things that make up such a list:

1. Important phone numbers

The most important phone numbers – that is, those of your partner, family, neighbors or close friends – should be at the top of the list. It is also important to note who has the key to the apartment.

2. Bank details

Your relatives need the name of your bank and your telephone company. In addition, you can keep copies of your bank cards. This will make life easier for your loved ones, and yours too, in the event your wallet is stolen.

Ideally, you have given a banking power of attorney to someone you trust in good time, so that they can handle financial matters on your behalf after your death.

3. General practitioner, dentist, important specialists

As an emergency is not always a case of death, the list should include not only data from the most important doctors, but also information on blood type, allergies and intolerance to drugs.

4. Insurance

Insurance company data is important because it usually needs to be released immediately after a person dies. If the death is declared too late, there may be problems with the payment of the sum insured. Usually, a telephone message is sufficient and a copy of the documents can be presented later.

5. Tax identification number

The tax office also awaits a message and often a final tax return for the deceased. It is therefore important to note the tax identification number.

6. Passwords

Digital heritage should not be forgotten either. Write down the most important passwords for your online and social media accounts. This will make it easier for your loved ones to follow you and they will not have to send a letter to each company to inform them of your death and ask them to delete your account.

7. Health insurance

In addition to health insurance, data from supplementary insurance policies should also be included in the list, as they also need to be terminated after death.

8. Password for the PC

The list includes not only the passwords for your Internet accounts, but also your PC’s master password, if it is protected by such a password. Thus, survivors can access all important data, photos and documents.

9. Storage location for important digital documents

If you have backed up any documents or additional data to the cloud, you should also put them on the emergency list. So loved ones don’t have to search for them for hours.

What to do with the list?

An emergency list is confidential and should not fall into the wrong hands, especially if it contains passwords or a debit or credit card code. However, one or two trusted people can also receive a copy of the list and keep it in a safe place. Another solution is to deposit the emergency list at the bank, where only selected people can access it.

However, it is important that the list is updated regularly. You can do this, for example, at the same time as your annual contract review or your tax return. You can therefore tick an additional date for this purpose in your calendar.

Other important lists or documents:

In addition to an emergency list, there are other lists or documents that could be useful to relatives in the event of death:

- a list of all valuables; this way, your loved ones don’t have to search everywhere and know immediately where your valuables are,

- a power of attorney for health care; specifying who can make decisions for you if you need help,

- an end of life will

- your will.

While thinking about your own death may seem unpleasant or distant at first, it can make life and the lives of those close to you easier. It’s best to start today with your emergency list and think about what still needs to be clarified, supported, or prepared.

Moreover, an emergency is not necessarily a death. The theft of your purse, wallet, or loss of your cell phone can also be an emergency and make this list necessary.

The following articles will show you tips that can save you from emergencies:

Source: entspannteordnung

Cover images: ©flickr / Joel Bez ©flickr / beachgirlnbay